Uranium Market Insights: 2024 Performance and Industry Trends

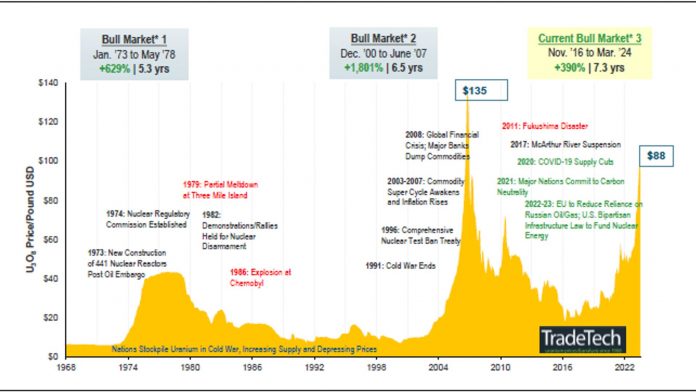

The uranium markets have seen mixed performance in March 2024, with the U3O8 uranium spot price declining while uranium miners and junior uranium miners saw gains. The spot price decreased by 6.84%, from US$94.60 to $88.13 per pound. On the other hand, uranium miners rose by 1.75% and junior uranium miners by 2.52%.

One of the key factors impacting market behavior is the strategic positioning of buyers, with some utilities and producers abstaining from active participation in the market. This “buyer’s strike” has influenced the recent price movements in the spot market. Despite the recent dip in prices, the longer-term outlook remains positive, with strong performance in physical uranium and uranium miners against other asset classes.

Looking ahead, the demand for uranium is forecasted to increase significantly, reaching 338 million pounds by 2040. This would require a doubling of the supply by then. However, challenges remain in increasing production, as evidenced by Kazatomprom, the world’s largest uranium producer, being unable to ramp up production in 2024 despite rising spot prices.

In response to the supply-demand dynamics, junior uranium mining companies have been making strides in answering the industry’s call. Companies like Ur-Energy and Global Atomic are working on restarting or building new projects to contribute to the supply-side response.

Industry developments such as the potential restart of the Palisades Power Plant in the U.S. and efforts to reshore uranium enrichment services highlight the shifting landscape of the nuclear energy sector. With geopolitical tensions impacting uranium mining operations in countries like Niger, the industry faces challenges that could affect supply stability.

Overall, despite the recent retracement in uranium prices, the market remains poised for further growth in the coming years. The need for increased production to meet growing demand, coupled with geopolitical uncertainties and industry developments, sets the stage for an evolving uranium market landscape with potential opportunities for investors.

The article discusses the performance of uranium markets in March 2024, highlighting various key takeaways. It mentions that the U3O8 uranium spot price declined by 6.84% while uranium miners and junior uranium miners saw gains during the month. The influence of buyers abstaining from active participation in the market is noted as a key factor affecting market behavior. The article also forecasts the demand for uranium to increase significantly by 2040 due to the importance of nuclear energy for energy security and decarbonization.

Furthermore, the article discusses the challenges faced by the world’s largest uranium producer, Kazatomprom, in increasing production despite rising U3O8 spot prices. It outlines supply constraints in the market and the need for a significant increase in uranium supply to meet future demand. The article also touches upon industry developments, such as the restart of nuclear power plants in the U.S., potential new mining projects, and geopolitical factors affecting uranium miners in Niger.

Overall, the article suggests that the uranium market may present an attractive entry point for investors, considering the long-term supply deficit and the growing demand for uranium in the energy sector.